What’s inside?

The Iran attack…Venezuela oil sanctions are back…decreased Russian oil trading…IUU fishing…

There was recently some volatility and noteworthy developments, as always. Check out the easily-digestible maritime global trade highlights and trends we are sharing this week, powered by Maritime AI™ insights.

Before diving deep, take a look at Windward’s refreshed homepage!

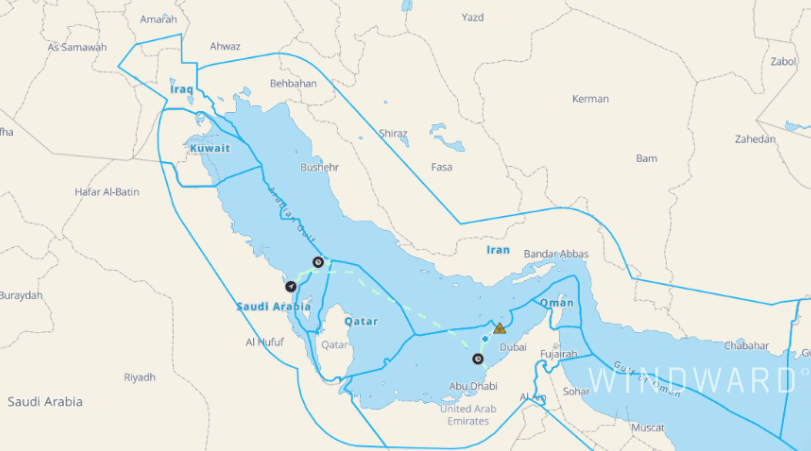

The MSC Aries Seizure in the Strait of Hormuz

- The Iranian Revolutionary Guard Corps seized the MSC Aries (IMO: 9857169), a 366-meter container vessel, while en-route to the Hormuz Strait on April 13. The IRGC claimed that the vessel was seized due to a link with Israel.

- The MSC Aries is owned by the British company “Zodiac Maritime Limited,” which is connected to Israeli businessman Eyal Ofer.

- Windward insights show that the vessel was seized after crossing the EEZ border between the UAE and Iran, at 25°39’40″N, 54°59’19″E, after the vessel made a port call at Port Khalifa, the UAE.

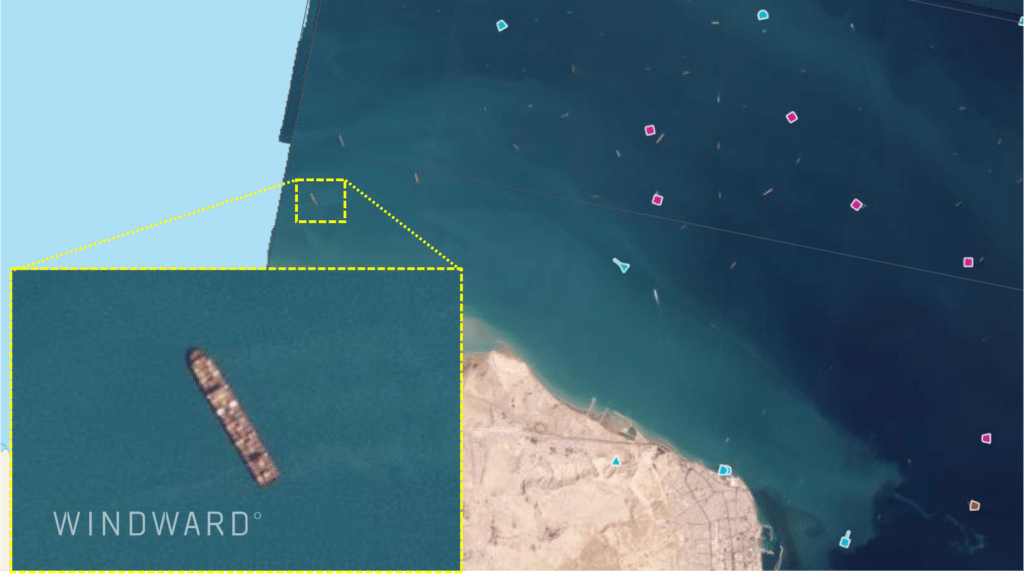

Optical satellite imagery shows that on April 14, a candidate vessel similar to the MSC Aries anchored at the Iranian EEZ, near the port waiting area of Bandar Abbas, at 27°0’50″N, 56°18’38″E.

Impact of the Iranian Attack and Seizure of MSC Aries on the Supply Chain – Behavioral Patterns

- Iran launched a missile attack against Israel on April 13.

- Prior to the attack, Windward insights show several behavioral patterns that were likely in response to the looming attack:

- The number of port calls in Iran by cargo vessels and tankers decreased by 35% between March 30-April 14, 2024.

- There was a 450% increase in destination updates in the Arabian Gulf that showed similar patterns of evasive acts (armed guards onboard, no connection to Israel, all crew Chinese/Syrian/Russian, etc.) over the last week and up to April 12.

- In addition, between April 4-11 there was a 50% increase in vessels that anchored for over six hours in Suez (North and South port waiting areas), probably waiting for further directions for entry to the Red Sea, because of the situation.

- There was a 200% increase in dark activities conducted by cargo vessels in the Gulf of Oman and Strait of Hormuz between April 12-13, probably by vessels trying to hide their location after the seizure of the MSC Aries.

Compliance Risk Will Rise (Iran and Venezuela)

The U.S. and Europe seem to be planning new sanctions on Iran following its attack on Israel and vessel hijacking. Plus, the U.S. just reimposed oil sanctions on Venezuela.

“Crushing oil sanctions” were reimposed on Venezuela by the Biden administration on Wednesday, according to the AP, due to election concerns.

“A senior U.S. official, discussing the decision with reporters, said any U.S. company investing in Venezuela would have 45 days to wind down operations to avoid adding uncertainty to global energy markets. The official spoke on the condition of anonymity to discuss U.S. policy deliberations.”

For organizations assessing due diligence and geopolitical risk, things just got much more complicated. Stats from TankerTrackers.com show that Iran has been exporting almost twice as much oil than a couple of years ago.

How will you change your approach, given the increased risk?

Decrease in Possible Russian-Related Oil Trade – STS Classification

- By combining Windward’s upcoming Ship-to-Ship (STS) classification search engine capability and Sequence Search function, we see a decrease in commodity STS meetings following a port call in Russia conducted by Russian-affiliated crude oil tankers that are either flagged as high/moderate risk, or are sanctioned.

The data shows that the number of STS meetings followed by a port call in Russia decreased in the Greece EEZ (48% decrease between February-March 2024), and Malaysia EEZ (34% decrease between January-March 2024).

- But data shows that between February and March 2024, the number of commodity STS meetings after a port call in Russia increased in Russia’s EEZ (240% increase) and Iraq’s EEZ (900% increase).

Commodity STS meetings by sanctioned/high/moderate compliance risk crude oil tankers following a port call in Russia, May 2023-March 2024.

- Additionally, data shows a significant decrease in the number of commodity STS meetings by crude oil tankers that were conducted after a dark activity in Russia and the Black Sea

- Ukraine EEZ: 37% decrease between January-March 2024

- Greece EEZ: 50% decrease between February-March 2024

- Malaysia EEZ: 40% between February-March 2024

However, our Maritime AI™ insights show that the number of commodity STS meetings after a dark activity in the Black Sea and Russia EEZ increased by 166% between February-March 2024.

Commodity STS meetings by sanctioned/high/moderate risk crude oil tankers after a dark activity in Russia and the Black Sea, May 2023-March 2024.

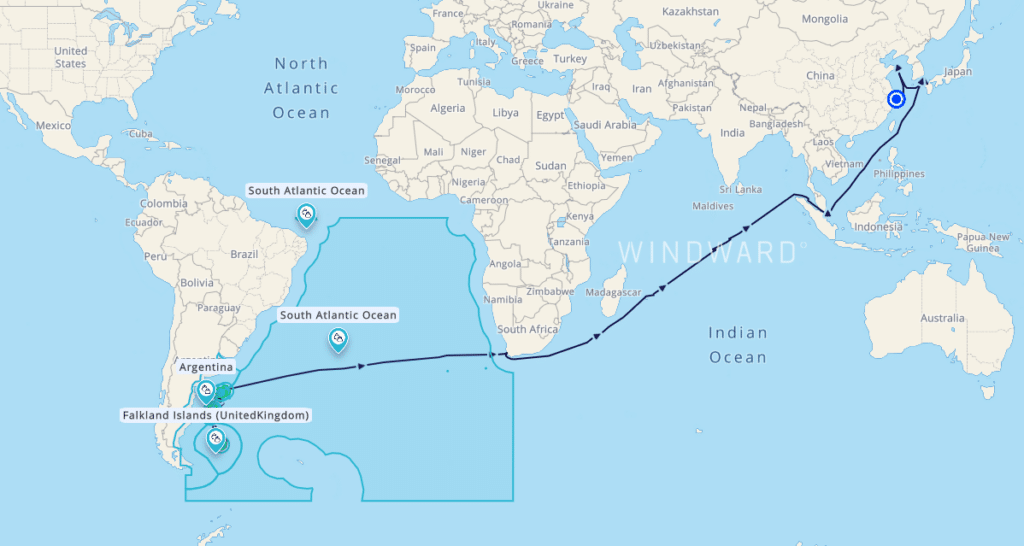

Increase in IUU Fishing-Related Activity in Argentina and the South Atlantic Ocean

- There has been an increase in fishing vessels conducting Illegal, Unregulated, and Unreported (IUU) fishing operations in South America in recent years, with Argentina and the South Atlantic Ocean being one of the most targeted areas for IUU fishing due to the fertile sea shelf.

- Sources also pointed out that China is operating the largest Distant Water Fleet (DWF) in South America, which makes it one of the largest actors related to IUU fishing. The sources pointed out that these vessels regularly use deceptive shipping practices to hide their operations and location, such as deliberately disabling their AIS signals (“dark activity”).

- More recently, the Argentinian authorities’ joint Maritime Command (COCM) launched an operation against IUU fishing vessels in the South Atlantic Ocean. In addition, the U.S. Coast Guard reported it will join the efforts in fighting IUU fishing in the region, and began conducting joint exercises with the Argentinian Navy.

Windward’s STS classification shows a similar increase in STS commodity meetings between Chinese-flagged high/moderate IUU risk vessels with reefer vessels in the South Atlantic Ocean and Argentinian EEZ. There was a huge 875% increase in commodity STS meetings from March-April 2023 and a 350% increase between March 30-April 13, 2024. The data also shows that during the months of January-March in the last two years, there was a matching increase in dark activities by these vessels, which can be an indicator for fishing operations by IUU vessels.

Commodity STS meetings by Chinese-flagged high/moderate IUU risk fishing vessels in the South Atlantic Ocean and Argentinian EEZ with reefer vessels. January 1, 2023-April 13, 2024.

- Further examination, using Windward’s Sequence Search shows that reefer vessels that conducted commodity STS with Chinese flagged high/moderate IUU risk fishing vessels largely arrived after the meeting at China’s port of Ningbo.

- The data might suggest a possible pattern of operation for IUU fishing and seasonal flow – in March, vessels may conduct illegal fishing operations by using dark activities. In April (after the season ends), they deliver the fish to reefers to be carried to their next destination (mostly to China).