What’s inside?

There is a lot of news around the Red Sea crisis, but you don’t want to miss Windward’s unique, AI-driven insights. We have concentrated some of our best pattern and trend findings, data, and predictions in one place for your convenience.

Trade flows, freight rates, deceptive shipping practices, areas to watch, and more have changed since this crisis started. We are pleased to help you stay ahead with our Maritime AI™ insights in our role as trusted maritime and supply chain advisor.

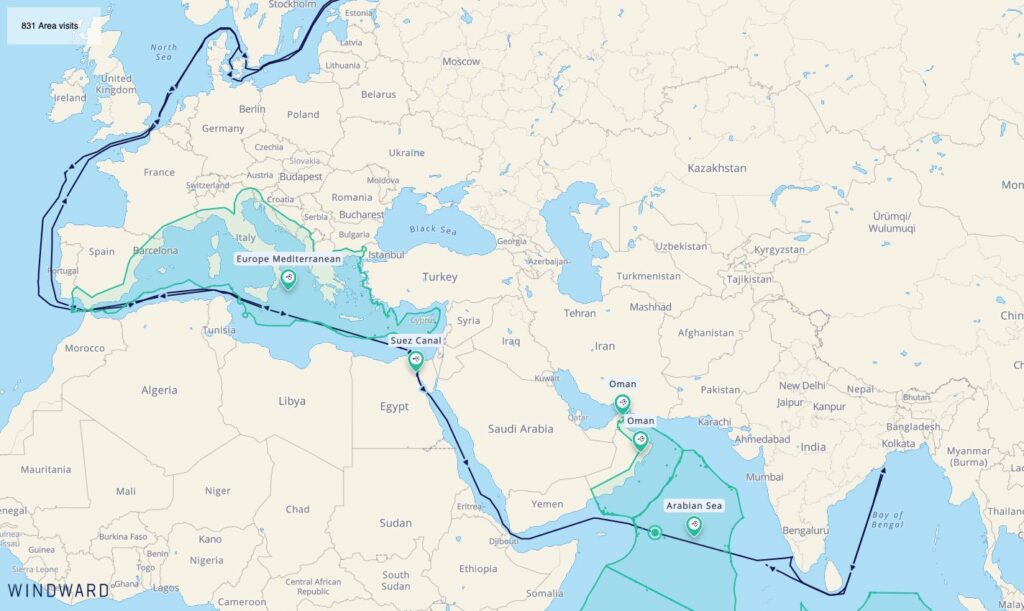

The Bunkering Redirection

The redirection of maritime traffic has not only altered global shipping routes and costs, but also reshaped the geopolitical and economic landscapes, affecting bunkering operations and introducing new challenges in detecting and combating illicit activities.

There has been a 50% increase in bunkering operations in East Asia, a 40% rise in bunkering ship-to-ship (STS) engagements in Europe, and a corresponding 20% decrease in the Middle East, according to Windward’s Maritime AI™ platform’s analysis of container vessel bunkering between October 2023 and January 2024.

A relatively recent article by Reuters supports these findings, noting that refueling demand has increased in Singapore due to ship diversions from Red Sea tensions. Container vessels are seemingly avoiding bunkering in the Middle East, and prefer bunkering before and after sailing through the Cape of Good Hope.

Actionable Insights

- Shipping companies or operators – this reshuffle can help you source better deals on bunker fuel. Perhaps go to places where the demand is lower to find a better deal.

- Bunkering companies – things are moving. Get your hands on real-time intelligence and make some calls to new prospects.

- Port authorities – don’t be unpleasantly surprised by using outdated data. Get real-time intelligence and direct your operations accordingly

Important reminder: bunkering deals can be concluded in as little as fifteen minutes, so organizations cannot reasonably stretch the sales process to an hour to conduct due diligence, without risking a lost opportunity.

A 77% Increase in Route Deviations?!

On Tuesday, February 6, the Houthis claimed they fired missiles at two ships and caused damage. The group’s military spokesman said it had fired naval missiles at the Star Nasia and Morning Tide, identifying the Marshall Islands and Barbados-flagged ships, respectively, as American and British, according to Reuters.

Neither vessel was gravely damaged, based on Windward’s data, and kept sailing through the area. The vessels were targeted 57 nautical miles West of Hodeidah, Yemen.

Windward’s AI-powered insights show a 77% increase in route deviations in the Red Sea and Gulf of Aden by all vessels (January 24-February 4). Our data shows that the majority of the route deviations were conducted North of the Yemeni EEZ and East of the Gulf of Aden.

There was a sharp 700%(!) increase in anchoring for over five hours in the North Suez port waiting area (January 27-28). This is noteworthy, because it might suggest that vessels are still avoiding entry to the Red Sea and staying in the Suez, which might create more congestion in the area and greater delays in the supply chain.

Actionable Insights

- Uncoding port congestion – geopolitical tensions are high and trade flows continue to shift. Knowing where port congestion is accumulating will be critical for maintaining customer service, accurate tracking, cost savings, and much more.

- Get alerted – route deviation exception alerts are imperative for obtaining a full picture, monitoring trade flows, understanding what the major carriers and competitors are doing, etc.

Don’t Forget About Russian Oil…

Guess who’s still sailing through and trading in the Red Sea…

Red Sea and Suez Canal traffic is down 70%-80%. But more than 114 vessels that are marked as “High Risk” for Russia regimes took the route of Med –> Suez –> India/Asia during the past 60 days, according to Windward’s Maritime AI™ platform.

While many major energy companies and carriers are sending vessels on the long route around the Cape of Good Hope, Russian oil seems to still be flowing in the Middle East.

Unlike the Suez Canal, the Cape does not have checkpoints. Diverting a large number of ships there, rather than through the regulated Red Sea, may make illicit activities – such as oil and commodities smuggling, and illegal, unreported, and unregulated (IUU) fishing and its accompanying great power competition dynamics – easier and more common.

Actionable Insights

- Visibility into deceptive shipping practices and the ability to fully comply with evolving sanctions and regulations are a must-have during this time of rising geopolitical tensions. Our upcoming webinar on compliance can definitely help.

You Can’t Afford to Miss This!

Early next week we will release, Month of Mayhem: January Red Sea Crisis Report.

This comprehensive report features Windward’s unique Maritime AI™ insights and expertise to help you:

- Contextualize and quantify exactly what is happening

- Identify existing and coming trends

- Plan for the future, despite the current volatility in the Middle East

Stay tuned…