What’s inside?

Struggling with a regional drought, the Panama Canal limited the number of new reserved passage slots to help ease a bottleneck of ships back in August, according to Reuters. Panama maintained a restriction of the total number of vessels allowed to pass to 32 per day, from 36 daily in normal conditions.

In December, the Panama Canal Authority (PCA) decided to lower transits in January and February to 20 and 18 daily, but then changed the decision to increase the numbers to 24 per day. More than six months after the August changes, what has been the impact of limiting a crucial artery that typically handled five percent of global seaborne trade?

This blog post supplies you with the AI-powered insights you need regarding the Panama Canal’s impact and suggests ocean freight capabilities that can help you better navigate this difficult situation.

Record Lows for Container Vessels and Bulk Carriers

Container vessels and bulk carriers hit a record low during the past two years, while tankers are about to reach their peak.

Windward’s Maritime AI™ platform has found a significant decrease in the number of area visits by container vessels owned by the six major carriers – COSCO, CMA CGM, MSC, Maersk, Hapag-Lloyd, ONE – and bulk carriers. They decreased 30% and 51%, respectively. January 2024 marks the lowest number of area visits by container vessels and bulk carriers in the past two years.

In contrast, oil product tankers increased by 39%.

There are three potential reasons for the discrepancy between tankers vs. container ships and bulk carriers:

- Tankers are lighter than container ships and bulk carriers

- Tankers are generally smaller, with mid-sized vessels like Suezmax averaging around 275 meters in length, compared to large container ships such as the New Panamax at 366 meters

- The Biden administration’s removal of a broad array of sanctions against Venezuela’s oil and gas sector

Less Imported U.S. Goods Are Going Through the Canal

The U.S. holds the title of the Panama Canal’s largest user, with U.S. commodity exports and imports comprising approximately 73% of its traffic. Data from the U.S. Department of Transportation reveals that 186 million tons of U.S. imports and exports traversed the canal in 2023.

The canal serves as a conduit for 40% of all U.S. container traffic annually, representing about $270 billion in cargo.

The Panama Canal may be losing its dominance for U.S. imports, based on an analysis of the container supply chain. By using Windward’s new Sequence Search capability, which allows users to conduct advanced analysis of vessels’ behavioral typologies and trade movements by searching for sequences of activities, we identified a 40% decrease in port calls to the U.S. Central Coast and East Coast’s ports by container vessels that had previously crossed the Panama Canal.

There was also a 39% decrease in port calls in China by container vessels previously crossing the Panama Canal.

Route Deviations are Emerging

One alternative to navigating through the canal involves the LONG journey through the Drake Passage, situated near South America, extending the trip by approximately 20,000 kilometers for vessels traveling to and from the United States’ East Coast.

Windward’s data indicates a 5% rise in area visits by container vessels of the six major carriers in Argentina and Chile. Similarly, bulk carriers have seen a 2% uptick in visits to these regions. While this data could imply that container vessels and bulk carriers are beginning to detour around South America to bypass delays linked to the drought, the modest increase in visits does not yet firmly establish this as a widespread route deviation.

Another potential route deviation involves sailing around Africa via The Cape of Good Hope. Windward’s Maritime AI™ platform has detected several vessels that have traditionally crossed the canal now opting for this route instead.

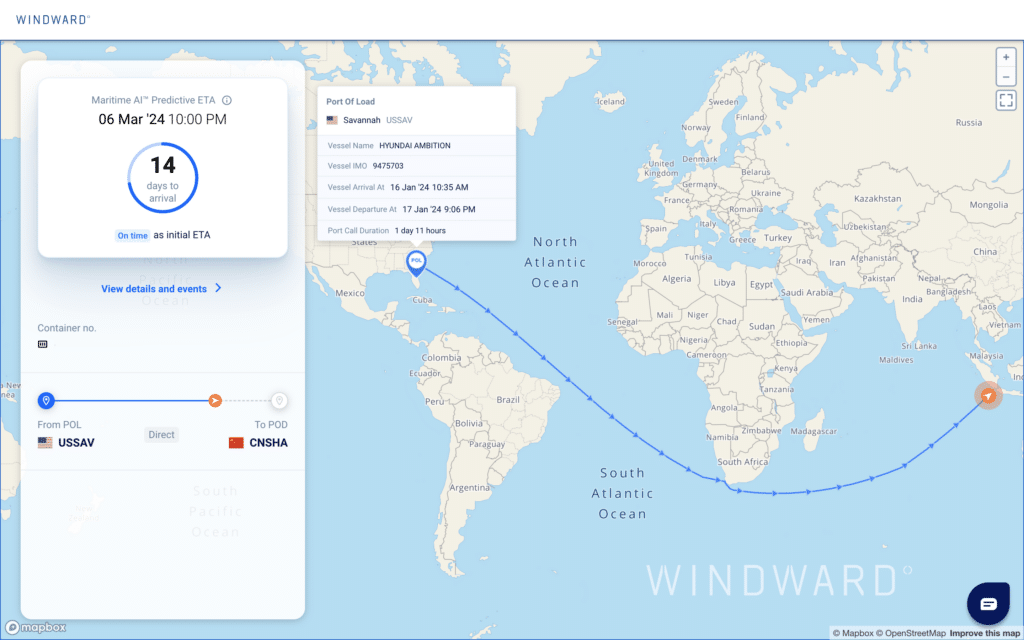

For instance, the cargo vessel Hyundai Ambition, measuring 366 meters in length, recently sailed from Savannah Port to Shanghai via the Cape of Good Hope. This is the current view of the Hyundai Ambition via Windward’s dedicated shipment page, featuring AI-based predicted ETA:

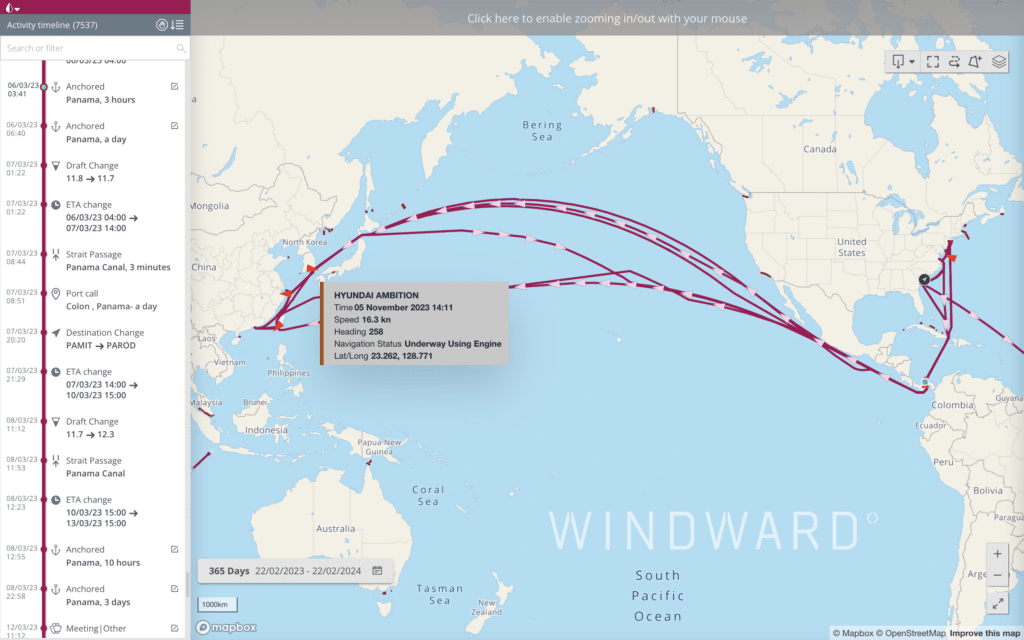

This marks the first instance in the past year, according to the platform’s historical patterns capability, that the Hyundai Ambition has taken this route. It had crossed through the Panama Canal on all six of its documented journeys in 2023/early 2024.

$8.5 Billion Committed to Infrastructure and Emission Reductions Amid Climate Challenges

The Panama Canal Authority (PCA) has unveiled an ambitious plan, allocating over $8.5 billion to sustainability projects over the next five years to address climate change effects. A quarter of these funds are earmarked for a more robust water management system. Additionally, a billion dollars will support digital transformation and decarbonization efforts at the waterway.

Since October 2023, the PCA has reported a drop of $100 million in toll revenue per month.

The main reason that led the PCA to limit the passage of vessels to 24 and reduce the draft limit is Gatun Lake. The 33 kilometer-long manmade lake has been sharply dropping since 2022 and the recent arid winter has certainly not helped:

The persistent drought, driven by El Niño, lowered the water level in Panama’s Gatun Lake to 81 feet, six feet beneath the normal levels needed for the Panama Canal’s locks to operate efficiently. In the past quarter, water levels fell below the critical 80-foot threshold.

Four Critical Capabilities for Navigating This Situation

Innovative AI solutions can help freight forwarders, importers, exporters, and logistics managers overcome the canal’s reduced capacity challenges. Effectively managing unforeseen events in maritime logistics is crucial. Customized alerts, as part of Windward’s exception management platform, are available to enhance supply chain efficiency, customer satisfaction, and cost-effectiveness. In the face of the Panama Canal’s unique challenges, these tools empower businesses to identify and resolve anomalies in the maritime logistics process proactively.

1. Real-Time Exceptions

Exception management empowers people to quickly realize what’s not happening according to the plan, prepare alternative plans, proactively manage customer relations, and work to mitigate unwanted fees and charges. This includes transshipments, rollovers, and route deviations.

Windward’s newly launched route deviation exception alert will provide stakeholders with enhanced visibility. Early knowledge of impacted shipments enables companies to optimize their operations, whether it’s adjusting timelines or reallocating resources to ensure timely delivery.

2. Maritime AI™ Predicted ETAs

The crisis at the canal often leads to delays. Access to predicted ETAs through Maritime AI™ enables stakeholders to adapt to these disruptions and optimize their operational planning. Such insights are invaluable for making on-the-fly adjustments to routes and schedules.

3. Full Milestone Visibility

Crucial milestones, such as the actual time of arrival (ATA) and the actual time of departure (ATD), are not provided by most carriers. Keeping track of critical dates, such as ATA and ATD, has many important benefits. This tracking can be used to validate late fee invoices – instead of wasting money on inaccurate detention and demurrage charges –

4. Port Congestion Insights

A comprehensive understanding of port congestion is essential for staying informed about the evolving situation in the Panama Canal region. This knowledge is vital not only for assessing the current state but also for anticipating how it may impact other areas and ports in the future.