DPRK Sanctions Evasion: Evolving Tactics

What’s inside?

It was a cool, clear January night in the middle of the East China Sea. Gentle waves lapped against the hull of the Dominica-flagged ‘Yuk Tung’. For miles all around there was nothing – nothing except for the designated North Korean tanker, ‘Rye Song Gang 1,’ with whom it was conducting a transhipment of petroleum products, in breach of UN sanctions.

This is just one example of how the DPRK routinely – and systematically – evades sanctions, according to a report by the UN Security Council’s Panel of Experts on North Korea published last March. Its latest report – made public on Tuesday – documents how Pyongyang is accelerating its import of petroleum products through illicit ship-to-ship transfers and stepping up coal exports.

It’s a modus operandi that isn’t unique to North Korea. On the other side of Eurasia, two vessels the U.S. Treasury suspected might have dabbled in similar shenanigans for Syria were involved in an explosion while conducting a ship-to-ship operation in the Kerch Strait.

According to the Windward platform, both ships were in the top 2% of the world’s riskiest vessels for smuggling – partly because in the previous 12 months they’d each gone dark for more than 75 days each. The average for the world LPG tanker fleet was three.

These developments haven’t gone unnoticed. In November, the U.S. Treasury’s Office of Foreign Assets Control (OFAC) issued an advisory specifically describing the evolution of new sanctions evasion techniques.

In this context, it’s clear that trading with North Korea is a no-no. But it’s not always so clear cut. And this presents a problem: businesses and vessel owners may end up enabling sanctions evasion – however unwittingly – and face fines, or reputational damage as a result.

Ensuring this doesn’t happen – maritime compliance – is only now emerging as a priority after OFAC laid out new guidelines. Practically-speaking, a good starting point might be to understand – and quantify – ship-to-ship (STS) operations and dark activities (where AIS transponders were likely switched off deliberately). We did this for the Persian Gulf and the east Mediterranean.

The Gulf

The Hormuz Straits serve as the entry point to the Persian Gulf. Since the U.S. reimposed sanctions on Iran last November, there has been a 33% spike in dark activities. The jump actually began before sanctions snapped back, as vessels prepared for life under embargo (see chart).

Further analysis of the Gulf area found that 4% of all tankers conducting dark activity belong to the National Iranian Tanker Company (NITC) fleet. However, these tankers were themselves responsible for over 11% of the total accumulated time of dark activity in the area (see map below) – revealing that deliberate turn-off-transmissions is common practice among NITC tankers.

Another way to look at these operations is to look at is the average duration of dark activity by NITC vessels. Over a six-month period, the median was 9.2 days, compared with an average of 3.3-days for the world tanker fleet (long periods of dark activity indicate higher risk, as STS transfers take time).

Eastern Mediterranean

Similar activities have been regularly taking place in the eastern Mediterranean, off the coast of Syria. Like its ally, Iran, Syria is subject to wide-ranging sanctions, mostly on oil and arms, due to its civil war. The map below shows the clustering of dark activities between Syria and Cyprus (note the particularly high concentration near the Syrian port of Tartus).

To better understand this clustering, we compared the number of Syrian port calls made by cargo vessels and tankers in 2017 and 2018 (see chart).

The drop in port calls detailed above, together with the dark activities detected near Syrian ports imply a pattern of dark port calls.

Whatever the case, the UN Security Council’s Panel of Experts on North Korea is clear that sanctions evasion techniques will continue to become more sophisticated and harder to trace; sanctioned entities will always find new ways to evade controls.

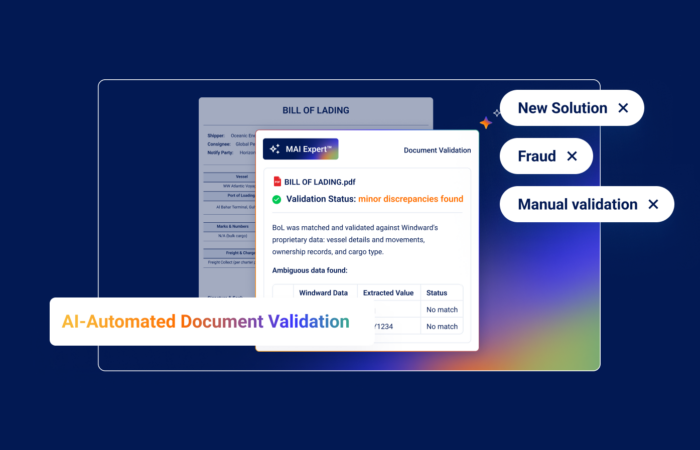

Technology can help. Not only in raising maritime compliance levels, but by streamlining workflows to ensure business continuity. That should keep business managers – as well as risk managers – happy, while simultaneously ensuring greater confidence in meeting regulatory expectations and avoiding being a footnote in the next UN report on North Korea.

Omer Zicher is a Product Manager at Windward

Dror Salzman is a Customer Success Manager at Windward